On March 25, 2025, Delaware enacted Senate Bill 21, which introduces significant changes to the Delaware General Corporation Law. The amendments put in place a statutory structure that provides guidance on the considerations, procedures and approvals required to obtain safe harbor protection for acts or transactions in which a director, officer or controlling stockholder may be conflicted, and provides greater clarity on what constitutes a disinterested director and controlling stockholder.

The new law also purports to rein in the scope of document production under Section 220, which governs a stockholder’s access to corporate books and records – though, as discussed in detail in this Cooley post, “Delaware Amends Section 220 – Will Scope of ‘Books and Records’ Production Be Limited?,” some wonder whether an exception based on “compelling need” might swallow the new rule.

Recent case law expanded scope of conflicted transactions subject to heightened judicial review

The amendments are intended to temper concern in the business community and a growing sense of unpredictability regarding corporate governance standards under Delaware law, which has led to some Delaware corporations reincorporating in other states and an increasing worry in Delaware that many others would follow. Recent Delaware decisions have expanded the scope of conflicted transactions subject to entire fairness review. At the same time, many dealmakers found the process for cleansing a conflicted transaction and obtaining the so-called MFW protections so burdensome, fraught with foot faults and ripe for litigation that some preferred to defend the transaction under the entire fairness standard.

The amendments set forth a statutory structure with specific and clear guidelines for obtaining safe harbor protection for conflicted transactions that modify the cleansing process with respect to conflicted transactions in ways that make it easier for companies to comply with, and more difficult for stockholders to challenge. The amendments also provide greater clarity on what constitutes a conflicted transaction.

Revamped Section 144 clarifies process for safe harbor protections

The amended Section 144 outlines the process for obtaining safe harbor protection for conflicted transactions.

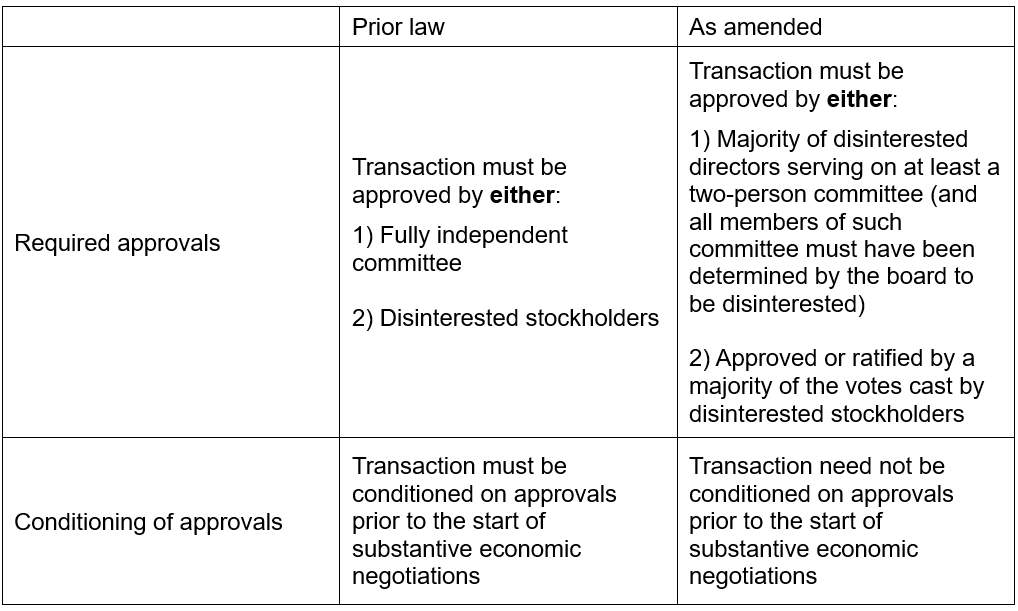

Transactions with majority interested board

Overview of new regime:

- One approval is sufficient. Either independent committee or majority disinterested stockholder approval is sufficient.

- Approvals need not be conditional at the outset. The amendments do away with the requirement to condition a deal on approvals prior to the start of substantive economic discussions.

- Board must determine that all members of the committee are disinterested. The material facts as to the conflict must also be disclosed to all members of the committee.

- Lowers standard for stockholder vote needed. Votes cast serve as the denominator in disinterested stockholder votes, not outstanding shares.

- Ratification permissible. Disinterested stockholders holding a majority of the votes cast can vote to ratify a transaction after the consummation of the transaction.

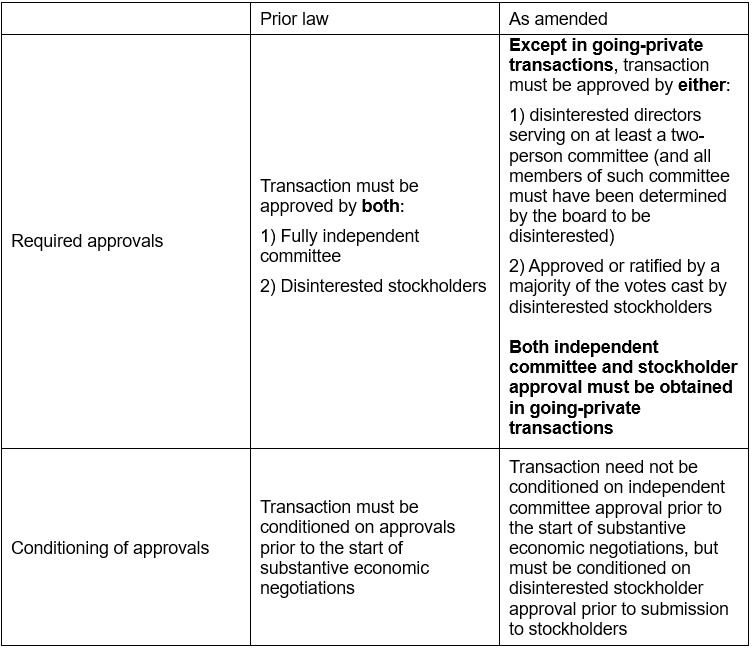

Transactions with controlling stockholders

Overview of new regime:

- Going-private transactions subject to higher standard. If the transaction is a going-private deal, then approval from both an independent committee and the majority of disinterested stockholders is required.

- One approval is sufficient in all other instances. Either independent committee or majority disinterested stockholder approval is sufficient.

- Board must determine that all members of the committee are disinterested. The material facts as to the conflict must also be disclosed to all members of the committee.

- Approvals need not be conditional at the outset. The amendments do away with the requirement to condition a deal prior to the start of substantive economic discussions, but the transaction must be conditioned on disinterested stockholder approval before submitting it to a vote (if relying on stockholder approval to obtain protections).

- Lowers standard for stockholder vote needed. Votes cast serve as the denominator in disinterested stockholder votes, not outstanding shares.

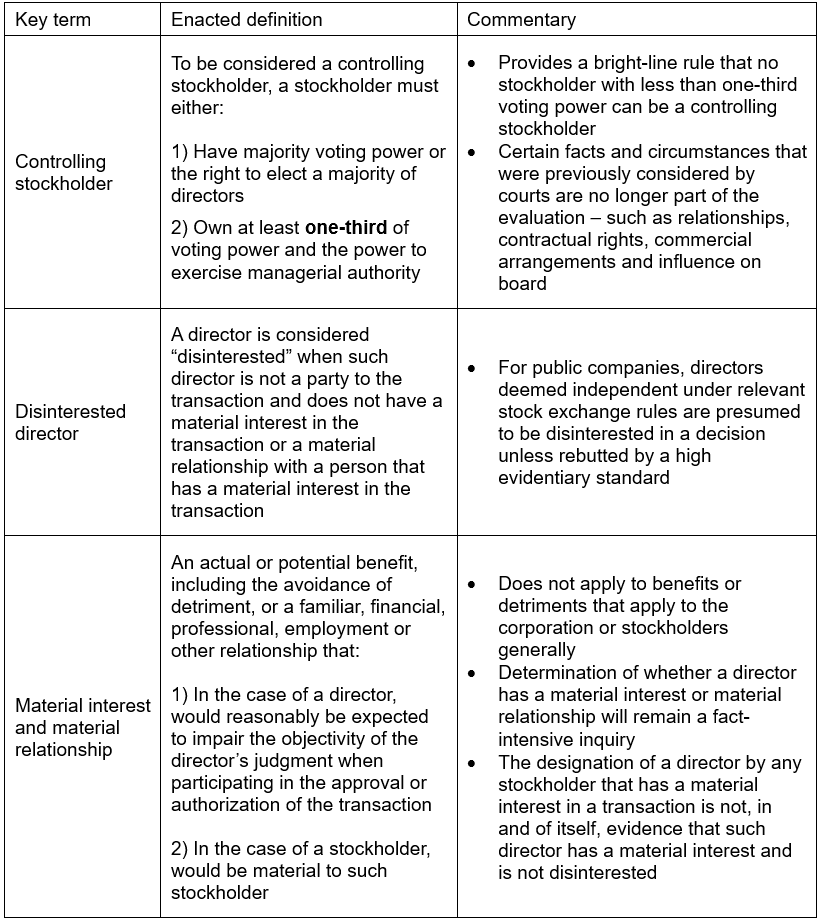

Definitional changes narrow scope of interested and control transactions

The amended Section 144 also statutorily defines key terms that determine whether a transaction involves an interested board or a controlling stockholder. Overall, these changes limit the scope of the types of transactions that would be considered conflicted transactions subject to heightened judicial review if not properly cleansed. Below we briefly summarize these new definitions.

Key considerations for boards and dealmakers following amendments

- Carefully consider directors’ interests. It remains important that the board make determinations as to director and officer interest carefully and consider any material interests or relationships directors may have in the transaction. In order to be afforded the safe harbor protections described above, any board committee approval of a conflicted transaction must be provided in good faith.

- Diligently document board meetings. Despite the changes in law, companies should continue to carefully minute the discussions and decisions related to transactions –including the determination of conflicted parties, the rationale for any key decisions and the specific factors that were material to the board’s or a committee’s decision-making.

- Disclosures to the board and stockholders remain important. The statutory safe harbor protections only apply to conflicted transactions if the approvals by the board committee and/or stockholders, as applicable, are fully informed and any stockholder vote is uncoerced.

- Changes apply to all transactions, except if claims are already made. The amendments apply to all transactions, whether occurring before, on or after the effective date, except for transactions with actions or proceedings commenced in a court of competent jurisdiction that are completed or pending on or before February 17, 2025.