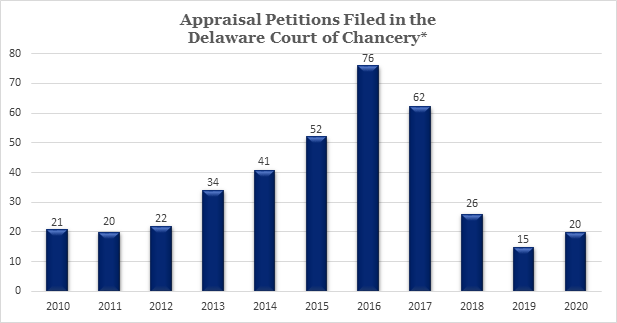

In a string of seminal decisions from 2017 through 2019 (DFC Global, Dell and Aruba), the Delaware Supreme Court re-shaped appraisal jurisprudence, in each case by overturning the Court of Chancery for failing to give adequate weight to deal price as the most reliable indicator of fair value. In the Delaware appraisal decisions that have followed, the court has consistently found deal price (minus synergies) to be the most reliable indicator of fair value, so long as there was a sufficiently robust sales process that bore “objective indicia” of reliability. With deal price acting as a ceiling on value in transactions with a meaningful sales process, the number of appraisal petitions filed in the Delaware Court of Chancery has significantly declined (as illustrated in the chart below), and the previous popularity of appraisal arbitrage appears to have dissipated.

*Source: Courthouse News Service and LexisNexis CourtLink

However, the Chancery Court’s most recent appraisal decision, In Re Appraisal of Regal Entertainment Group (Del. Ch. May 13, 2021), may provide new fodder for appraisal arbitrage. This post will explore some of the potential ramifications of that decision, along with other noteworthy takeaways from appraisal decisions since Aruba.

Adjustments to Deal Price for Changes to Value Between Signing and Closing

The Regal appraisal proceeding arose from Cineworld’s acquisition of Regal Entertainment Group in February 2018. In Regal, the court found that the deal price was the most reliable indicator of the fair value, given the sales process and other objective indicia of reliability. To determine the fair value of Regal’s common stock at the effective time of the merger, the court reduced the deal price by $3.77/share, which represented the portion of the deal price attributable to projected synergies. After subtracting for synergies, the court then increased the deal price by $4.37/share to reflect the change in value of the target between signing and closing. The change in value was attributable to the passage of the 2017 Tax Cut and Jobs Act, which reduced Regal’s tax rate from 35% to 21%. Following the adjustments for synergies and changes in Regal’s value between signing and closing, the fair market value of Regal’s common stock was determined to be $23.60/share, a 2.67% increase over the deal price. This outcome is noteworthy because deal price typically operates as a ceiling on value in proceedings where the court has relied on that price as the most reliable indicator of fair value.

In an appraisal proceeding, the court is required to determine the fair value of the petitioner’s shares as of the effective time of the merger, which may differ from the deal price if there is a delayed closing. In the 2019 Stillwater appraisal proceeding, Vice Chancellor Laster was asked to adjust the deal price upwards to reflect a change in the price of palladium in the period between signing and closing, which he conceded had a direct effect on Stillwater’s value (Stillwater was in the business of extracting and processing rare minerals, including palladium). Vice Chancellor Laster cited multiple precedents that indicated such an adjustment could be warranted but noted that “the proponent of the adjustment must carry its burden by identifying a persuasive reason for the change and proving the amount” of the change in value. None of the cited precedents, nor Stillwater, found that an adjustment to the deal price was warranted for temporal fluctuations between signing and closing. The rationale for declining to grant an adjustment varied by case, but precedents suggest that changes to value should be sustainable, rather than temporary – e.g., the court declined to make an upward adjustment in the PetSmart appraisal, despite PetSmart’s stellar (and unexpected) financial performance between signing and closing because the court was “not convinced that these short-term improvements were indicative of a long-term trend.”

Unlike precedent transactions, in Regal, Vice Chancellor Laster found, and the parties agreed, that an upward adjustment to the deal price was warranted given the passage of the Tax Act. The parties disagreed on the value of such adjustment, with the respondent arguing that any adjustment should be minimal, in part because no other bidder emerged during the post-signing market check. The court rejected that argument given the limited set of potential bidders that could compete to acquire Regal and the unlikelihood of a potential topping bid due to Cineworld’s matching rights. The court ultimately increased the deal price by $4.37/share for changes in Regal’s value between signing and closing, which was less than the $7.32/share proposed by the petitioners, but more than the $0.92/share proposed by respondents. As a result of that adjustment, and after subtracting for proven synergies, the fair market value was determined to be 2.67% higher than the deal price.

Key Takeaway: It seems unlikely that this decision will lead to an increase in appraisal arbitrage to the levels experienced prior to DFC Global, Dell and Aruba, given that petitioners will need to prove (and quantify) any changes to target’s value between signing and closing. Furthermore, any increase in value between signing and closing would need to outweigh any reduction for synergies, otherwise fair value would still be less than the deal price. Nonetheless, parties should be mindful of the potential impact of Regal in transactions with delayed closings (particularly those with more significant gaps between signing and closing), as it provides a roadmap for would-be appraisal arbitragers to potentially capitalize on increases in target’s value between signing and closing. Buyers should keep a detailed record of any internal discussions and deliberations regarding deal price, and carefully document the type and amount of expected synergies reflected in the deal price, as synergy reductions will help to counteract any upward adjustment for increases in value.

Adjustments to Deal Price for Synergies

Delaware’s appraisal statute requires the court to determine the fair value of the petitioner’s shares “exclusive of any element of value arising from the accomplishment or expectation of the merger of consolidation”. To do this, the court must “exclude from any appraisal award the amount of any value that the selling company’s shareholders would receive because a buyer intends to operate the subject company, not as a stand-alone going concern, but as part of a larger enterprise, from which synergistic gains can be extracted”.

In both the Regal and Panera appraisal proceedings, the court reduced the deal price for the value of synergies, but at less than the full amount claimed by the respondents. In Panera, the court relied heavily on the buyer’s internal documentation in valuing synergies, ultimately awarding synergies for projected cost savings and tax benefits, but declining to reduce the price for projected revenue synergies because buyer was unable to produce any documentation indicating that revenue synergies were reflected in its deal price. In Regal, the court undertook a thorough analysis of each of the synergies claimed by respondent. In analyzing synergies, the court clarified that the deal price would be reduced for buyer’s expected synergies, even if those synergies were not ultimately achieved (so long as they were accounted for in the price). For example, certain transfer pricing synergies were made impossible by virtue of the Tax Act, but the court still reduced the deal price for those synergies because Cineworld proved that they were expected at signing and accounted for in the deal price.

Key Takeaway: As courts increasingly rely on deal price as the most reliable indicator of fair value in an appraisal proceeding, buyers should carefully document and quantify any expected synergies reflected in their financial models used to support the deal price. For synergies to reduce deal price, buyer will also need to prove that such synergies could not be achieved absent a sales transaction.

Pre-Payment of Appraisal Award Non-Refundable

Delaware’s appraisal statute provides that any appraisal award shall accrue interest at 5% over the Federal Reserve discount rate, compounded quarterly from the effective time of the merger until the payment of such award. In an earlier blog post, we discussed how this statutory interest requirement led many activists to “buy into” appraisal claims in an effort to collect such interest, the amount of which was often significant given that appraisal proceedings generally take two to three years to finalize. In an effort to reduce appraisal arbitrage, Delaware amended the appraisal statute in 2016 to permit companies to prepay the deal price, stopping the clock on the statutory interest accrual. However, the court’s January 2020 decision in the Panera appraisal proceeding provides a cautionary tale about the downside of prepaying the deal price for appraisal shares. In that proceeding, the court refused to order a refund when the fair value was determined to be less than the prepaid deal price.

Panera Bread was a publicly traded company that JAB Holdings B.V. took private in 2017 for $315/share. An appraisal petition was filed and Panera prepaid the deal price to the petitioners, as permitted by the Delaware statute. In the appraisal proceeding, Vice Chancellor Zurn found that the transaction bore several objective indicia of reliability, and accordingly, deal price was the most reliable indicator of fair value. As discussed above, respondent also proved several synergies, which were deducted from the deal price. Fair value was ultimately determined to be $303.44/share (3.67% less than the deal price). Because Panera prepaid the deal price, it argued that petitioners should be required to refund the overpayment, but the court disagreed. In an issue of first impression, the court held that the statute does not provide Panera with a basis for seeking a refund of the overpayment.

Key Takeaway: If a buyer is considering prepaying the deal price to appraisal petitioners, the buyer should endeavor to have the petitioners contractually agree to refund any overpayment in the event that fair value is ultimately determined to be less than the deal price. If petitioners are unwilling to agree to such a provision, consider whether prepayment is still advisable, particularly if the respondent is confident that the court will rely on deal price in the appraisal proceeding, and that any synergies will exceed the amount saved on interest (and that such synergies can be proven).

Waiver of Appraisal Rights

Another noteworthy appraisal-related decision following Aruba was Manti Holdings, which enforced a contractual waiver of appraisal rights. It is common for private corporations (particularly those that are PE-backed or VC-funded) to have a stockholders agreement containing a drag-along right, which requires minority stockholders to participate in a change of control transaction approved by the board (or, in some instances, the controlling stockholder) and take a number of other actions in connection with such sale, including waiving any appraisal rights. In Manti, the court affirmed that an advanced waiver of appraisal rights by a sophisticated party was enforceable.

Key Takeaway: An advanced contractual waiver of appraisal rights is enforceable between sophisticated parties, but parties seeking to enforce such a waiver will need to ensure that the terms of the agreement triggering such a waiver are strictly adhered to, including any notice requirements.[1]

Conclusion

Decisions following Aruba have consistently adhered to deal price as the most reliable indicator of fair value where there is a sufficiently robust sales process, as reflected in the table below. However, as the Regal decision highlights, the deal price may not operate as the absolute ceiling on value in circumstances where the target’s value increased significantly between signing and closing, and the increase in value exceeds the deduction for the value attributable to synergies. Understanding that parties may take advantage of those fluctuations, buyers should endeavor to keep detailed records supporting their financial models and any deliberations relating to the deal price, and to document and quantify, where possible, any projected synergies reflected therein.

[1] In Halpin v. Riverstone Nat’l, Inc. (Del. Ch. Feb. 26, 2015), the court found that plaintiffs had not waived their appraisal rights because the controlling stockholder did not strictly adhere to the terms of the stockholders’ agreement. In order to invoke the drag-along right, which triggered the minority stockholders’ obligation to waive appraisal rights, the controlling stockholder was required to provide advance notice of the proposed merger, which it did not do.

Selected Appraisal Decisions Since Aruba Using Deal Price

| Case Name | Difference from Deal Price (%) | Adjustments to Deal Price | Noteworthy Aspects of Sales Process | Status |

| Columbia Pipeline (VC Laster – Del. Ch. August 2019) | 0 | No | Arms-length transaction with third party; unconflicted board; buyer conducted diligence which included non-public information; pre-signing market check; multiple price increases extracted | Final (no appeal of appraisal decision; interlocutory appeal of fiduciary claims dismissed on April 14, 2021) |

| Stillwater Mining Company (VC Laster – August 2019) | 0 | No | Despite single-bidder strategy, meaningful post-signing market check; arms-length transaction with third party; unconflicted board; multiple price increases extracted | Final (affirmed on appeal on October 12, 2020) |

| Panera Bread (VC Zurn – Del. Ch. January 2020) | -3.67% | Yes, reduced for synergies | Arms-length transaction with third party; unconflicted board; buyer conducted diligence which included non-public information; two price increases extracted; non-preclusive deal protections | Final (no appeal) |

| Regal Entertainment (VC Laster – Del. Ch. May 2021) | +2.61% | Yes, reduced for synergies and increased for changes in value between signing and closing (due to passage of Tax Act) | Arms-length transaction with third party; open and active post-signing market check; unconflicted board | Final (no appeal) |

Selected Appraisal Decisions Since Aruba Using Valuation Method Other than Deal Price

| Case Name | Difference from Deal Price (%) | Court’s Valuation Method | Noteworthy Aspects of Sales Process / Target | Status |

| Jarden Corporation (VC Slights – Del. Ch. July 2019) | -20.28% | Unaffected market price | Deficiencies in sales process (lead negotiator acted with little to no board oversight and no pre or post-signing market check); public float of 93.9%; heavily traded; financed equity offering at close to unaffected market price shortly prior to sale | Final (affirmed on appeal on July 9, 2020) |

| SourceHOV (VC Slights – Del. Ch. January 2020) | +12% | DCF | Private target; unreliable sales process | Final (affirmed on appeal on January 22, 2021) |

| Synapse Wireless (VC Slights – Del. Ch. July 2020) | -50% | DCF | Private target; unreliable sales process; no pre or post-signing market check | Final (petition for reargument denied on December 1, 2020) |

You must be logged in to post a comment.